Search a country below for debt collection:

How to Instruct Us

We simply require the following details:

Full name & address of the debtor

All available contact details of the debtor i.e. contact name(s) / Tel / Mobile / Email(s)

Amount owed (Invoice(s) or Statement will help)

Or ask us to call you – just leave us your details:

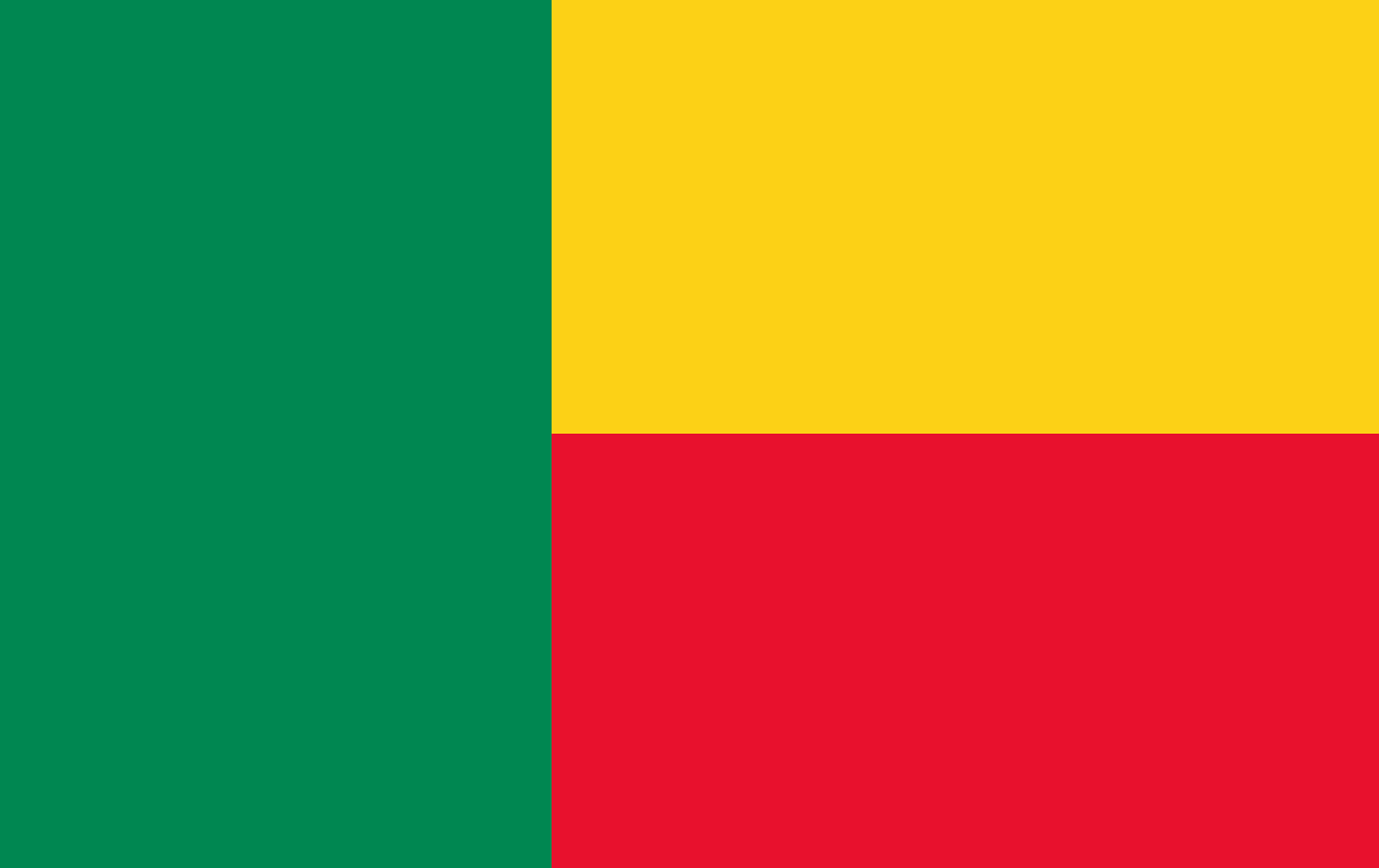

Benin Debt Collection – No Win No Fee

Creditreform operates a global specialist International debt collections service. We have local offices and fully approved expert international debt collection agency partners in every country worldwide. All our International debt collection agency partners and offices operate on a No Win No Fee basis charging an agreed commission against monies recovered only. All our international offices and partners initiate the collection processes by sending the debtors a debt collection letter to introduce their involvement.

Main reasons why a local country debt recovery agency is so important rather than trying to recover from a debt collection agency UK are as follows:

The local International Debt collection Partners know:

The local cultures

The best methods of initiating debt recovery letters and processes

The languages

The laws

Are in the same time zones

Herewith details of our debt collection service Benin:

Location of debt recovery office in Benin?

Cotonou. All debt collection letters are sent by the local head office.

Number of debt collection staff?

6 staff. Each staff member is allocated a client and all their debt collection letters are personalised in order to effect the best response results from debtors.

How long have you been operating a debt recovery service in Benin?

We have been operating an African debt collection service on a no win no fee basis in Benin since 1984. Benin is included on our debt collection agency list.

What type of debt collection services do you provide? Do you do commercial debt recovery (B2B) and consumer debt recovery (B2C)?

We handle both Business to Business debt recovery cases and Business to Consumer debt collections cases. There is different content for business to business debt collection letter templates and business to consumer debt collection letters templates.

Statue of Limitation in Benin?

Obligations arising in the course of their trade between traders, or between traders and non-traders, are prescribed by five (05) years if they are not subject to shorter requirements, in accordance with the provisions of the Uniform Act on General Commercial Law.

Benin civil litigation statute of limitations is a law that time limits a plaintiff’s right to bring a claim against a defendant. The statute of limitations in Benin is 6 years. However, if an action has been taken within this time then the statute of limitations time will be extended to account for this. Once the specified time period elapses then no action can be taken through the legal processes unless the plaintiff is able to prove exceptional circumstances. Other Statute of Limitations include:

Benin Open Account Years – 2 years

Benin Promissory Notes – 2 years

Benin Written Contracts – 2 years

Benin Oral Agreements – 2 years

How EU (European Union) laws effect debt collection in Benin?

Has very little impact in Benin.

Benin provisionally signed a free trade agreement (FTA) as part of The Economic Community of West African States (ECOWAS or CEDEAO in French) which included 16 African states together with the European Union (EU) in 2014. This is referred to as the Economic Partnership Agreement between the ECOWAS and the European Union. The other ECOWAS member states are Burkina Faso, Cape Verde, Côte d'Ivoire, Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Mauritania, Niger, Nigeria, Senegal, Sierra Leone and Togo.

How many companies registries in Benin for businesses (i.e. UK has just 1 central registry)?

There is 1 company registry in Benin which is called Agence de Promotion des Investissements et des Exportation / Ministry of Industry, Trade, Small and Medium Enterprises – Business Registry (GUFE) located at Immeuble APIEX/ANAEP, Lot 368 Face Hall des Arts, 01 BP 5160 Cotonou BENIN.

We have access to Benin Company Registry searches to find out who further background information on all Benin companies.

Average length of time to collect a debt?

The average time taken to recover a Benin B2B debt collection case varies from case to case but we find it typcially takes 3-6 months on average for Benin collections.

Can late payment fees / interest to be added to claims?

Yes, Late payment fees / interest can be added to claims

The Court can be seized when formal notices become unsuccessful. No duration is determined for recovery. Benin has only one trade register (Registre de Commerce et du Crédit Mobilier).

In United Kingdom, the creditor may, in the event of non-payment by a debtor, initiate a debt recovery procedure, the starting point of which is the letter before claim. If this formal notice remains unsuccessful, he will choose the strategy to adopt according to certain circumstances such as the amount of the debt, the status of the debtor, the reasons given by the debtor for the non-payment of his debt so his assets. and its solvency, either a statutory demand with an obligation to pay within 21 days or a claim (request at the Court).

This statutory demand is effective only if the debtor has the means to settle the debt and is not contested. The amount of the claim must be greater than £750 for companies and £ 5,000 for individuals

In the event of a debt dispute (eg defective delivered products, non-compliant quantity, etc.) the statutory demand is less appropriate. It is advisable to complain courts to obtain a court order.

It is important to know that additional costs may be added throughout the trial. The losing party must pay the costs and expenses of the winning party in addition to its own costs and expenses.

If the debtor still does not pay despite the pronouncement of a judgment against him, even if this judgment has been rendered by a French court, the creditor may still demand execution in England under certain conditions.

Benin Business Credit Reports

Creditreform provides over 88 million international business credit reports throughout Europe and 200 million international business credit reports worldwide. We provide freshly investigated Benin Credit Reports which can be done prior to trading to make sure the company you will be dealing with can meet the commitment or once the debt becomes overdue to ensure the debtor can meet the amount owed.

Benin Skip Tracing Agents

Creditreform’s debt collection company service also uses expert local Benin tracing agent services to locate any absconded debtor. This debtor tracing service is provided on a No Find No Fee basis only charging for a successful trace.

Specialist Debt Recovery Experts

There are many unique requirements to recovering international debts in all countries including Benin debt collection services which differ from the UK and therefore it is very important that cases are handled directly by our expert international debt collection agencies and not from debt collectors UK. This method of international debt collection sets Creditreform aside from the competition who in many cases try and recover debts from a UK debt collector only. Using the local offices and partners enables us to achieve a far greater success rate and our No Win No Fee service together with competitive commission rates against monies recovered only ensures you get the best service.

Benin Debt Collection Partners in the following Benin Cities

Which countries border Benin?

Angola is bordered by Republic of the Congo, Democratic Republic of the Congo, Zambia, and Namibia in the south.

Who are the main trading partners for Benin?

What is the legal system in Benin?

The Benin legal system is based on Napoleonic Civil law.

What is the name of the Government Gazette in Benin?

The Gazette in Benin is called the Journal officiel de la République du Bénin - Official Gazette of the Republic of Benin.

What is the Supreme Court in Benin?

The Supreme Court in Benin is called the Constitutional Court of Benin, Supreme Court of Benin, High Court of Justice.

Benin Debt Collection Agency FAQs

1. How does a Debt collection agency in Benin recover overdue debts?

The debt collection process is initiated by an introductory letter to your debtor stating the amount owed to you and informing them of our involvement. Letters are then followed up with emails and telephone calls. From our experience the most effective part of this process will be the outsourcing to a third party debt collection agency in Benin as the debtor now has to resolve the debt and can no longer hide or provide lame excuses.

2. How long does the debt recovery agency in Benin take to process a case?

The debt collection case will be processed immediately up receipt and a letter sent normally by email and post. You will receive an automated confirmation by return.

3. What is the success rate for debt collection agencies in Benin?

The success rate of the debt recovery case depends on a number of factors including the solvency of the debtor and whether the case has a legitimate dispute. Our aim is to recover every debt that is recoverable.

4. Does the debt recovery agency in Benin operate a No Win No Fee debt collection?

We take on all debt collection cases on No Win No Fee basis only charging the agreed commission against monies recovered.

5. Why use a local debt recovery agency in Benin?

The reasons for using a local Benin debt collection agency than processing from a different country is the debt collector in Benin speaks the local language, knows the local laws and operates in the same time zones.

6. Are there any debts too old or too small for Benin debt collection?

We will assess all debt cases, irrelevant of age and size and then advise the best processes to recover these through the Benin debt collector.

7. How do I instruct the debt collectors in Benin?

Instructing the debt collectors Benin is a simple process. You just email details of the debt, debtor and amount to be recovered and the case can be initiated.

8. What evidence do I need to provide when instructing the Benin debt collector?

When instructing the debt collector in Benin just provide copies of invoices/statements, debtor contact details and any relevant information you may have to assist with the recovery process.

9. Who does the debtor pay?

In general the debt collector in Benin will request payments to be sent directly to the client but if not possible for any reasons will take payment directly. If payment is taken then cleared funds will be processed and sent to client straight away.

10. Can I instruct multiple cases?

You can send unlimited debt case instructions. Our systems will automate volume cases to meet your requirements.

11. Can you trace debtors in Benin?

Through our network of skip tracing agents we have an extremely high success rate of locating your absconded debtor.

12. How long does the debt collection process take?

On average the debt collections process takes 90 days to resolve an amicable debt recovery case. There are a number of factors that can delay this process but we will keep you informed every step of the way.

13. What are my options if debt collection in Benin is not successful?

If the debt recovery service is not successful we will advise you of your options including legal actions. Please note no legal actions or other processes will be taken without prior instruction from you.